food tax in maryland

In general food sales are subject to Marylands 6 percent sales and use tax unless a person operating a substantial grocery or market business sells the food for consumption off. Your gross receipts from sales of food and non-alcoholic beverages that are taxed at a 6 sales and use tax rate are subject to admissions and amusement tax at a rate no.

Sales Taxes Per Capita How Much Does Maryland Collect Conduit Street

Vendors should multiply their gross receipts by 9450 percent.

. In general food sales are subject to Marylands 6 percent sales and use tax unless a person operating a substantial grocery or market business sells the food for consumption. 5 cents if the taxable price is at least 67 cents but less than 84 cents. Hot soup hot pizza hot rotisserie chicken and warm roasted nuts.

While Marylands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales. Ad Register and Subscribe Now to work on Amended Maryland Tax Return more fillable forms. Depending on the type of business where youre doing business and other specific.

A Maryland FoodBeverage Tax can only be obtained through an authorized government agency. Food is generally taxable when sold in-store under the following conditions. The Maryland Department of Agriculture manages the program in cooperation with the Comptroller and has authority to issue up to 100000 in tax credits annually.

Machines are not taxable the tax applies to the sale of all other food including prepared food such as sandwiches or ice cream. The things that are taxed are taxed at the normal 6 state sales tax rate. Maryland has a higher state sales tax than 712 of states.

6 cents if the taxable price is at least. Despite opposition from the pet food industry the amended bill passed overwhelmingly in both houses of the maryland legislature. Maryland has exemptions to its sales tax for medicines residential energy and most raw groceries but not soda candy or alcohol.

PdfFiller allows users to Edit Sign Fill Share all type of documents online. Sale of beer wine. 4 cents if the taxable price is at least 51 cents but less that 67 cents.

However food items that are prepared for consumption on the grocers premises or are packaged for carry out are considered prepared food and are subject to a 6 sales tax. Depending on the type of business where youre doing business and other specific regulations. The tax rate is one-half percent 5 of the taxable price of the sale of food and beverages.

In general food sales are subject to Marylands 6 percent sales and use tax unless a person operating a substantial grocery or market business sells the food for consumption off. Are Food and Meals subject to sales tax. A Maryland Meals Tax Restaurant Tax can only be obtained through an authorized government agency.

Purchase breakfast lunch or. All sales of food and beverage are subject to the tax except the following cases.

States With The Highest Lowest Tax Rates

Maryland S Small Business Scorecard June 2019

Everything You Need To Know About Restaurant Taxes

Sales Taxes In The United States Wikipedia

Taxes Have Consequences Arthur B Laffer Jeanne Sinquefield And Brian Domitrovic Show Me Institute

Menu Bbq Restaurant Catering In Frederick Maryland Carterque Barbeque Grilling Co Carterque Barbeque Grilling Co

Maryland Income Tax Calculator Md State Tax Rate Community Tax

Umd Dining Services Destination Maryland Event Featuring Foods From Asia Africa The Middle East The Caribbean And Central And South America Year Of Immigration Global Maryland University Of Maryland

Baltimore City Maryland Department Of Human Services

Maryland S Tax Policy Has Improved But Still Falls Short Of Meeting Our State S Needs Maryland Center On Economic Policy

![]()

Restaurant Meals Program Maryland Department Of Human Services

As Food Prices Soar Some States Consider Cutting Taxes On Groceries

Need Help With Food Utilities And Tax Prep 2 1 1 Is Only A Call Away The Baltimore Times Online Newspaper Baltimore News

Washington Dc District Of Columbia Sales Tax Rates Rates Calculator

Your Guide To Maryland S Tax Free Weekend 2022

.jpg)

Montgomery County Volunteer Income Tax Assistance Program Vita

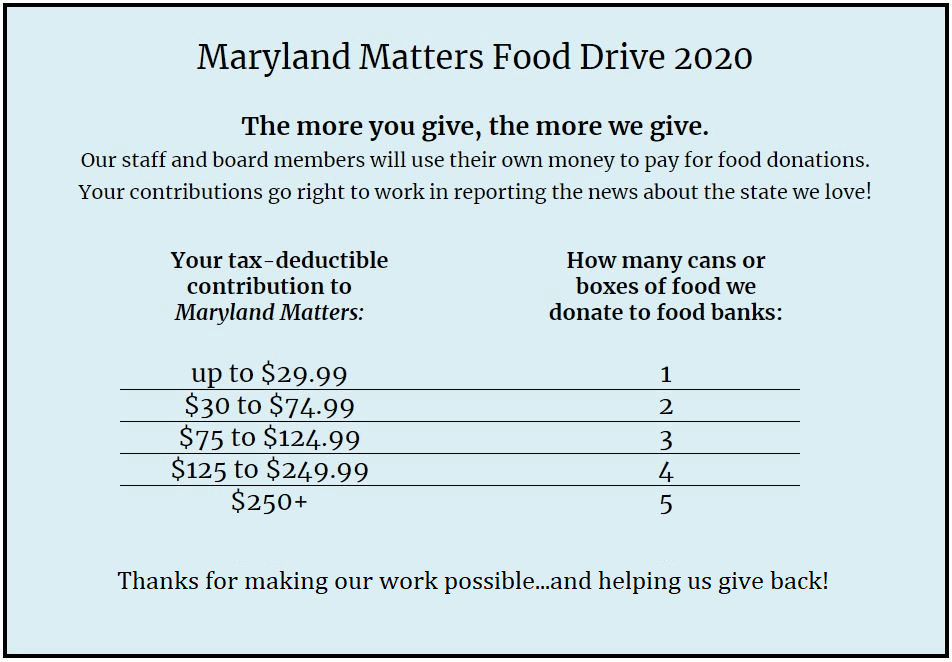

Update On Reader Generosity Maryland Matters